SHARE THIS ARTICLE

Are DeFi launchpads the best way to start a new project?

As the decentralized finance (DeFi) ecosystem continues to grow, new projects are emerging at an unprecedented rate. However, launching a new DeFi project can be a challenging and complex process, requiring significant resources and expertise in DeFi launchpad development. This is where DeFi launchpads come into the picture, providing a range of services to help new projects gain traction and funding. But the question remains: are DeFi launchpads the best way to start a new project? In this blog, we will explore the advantages and limitations of DeFi launchpads and help you decide whether they are the right choice for your next DeFi venture.

What are DeFi launchpads?

Decentralized Finance (DeFi) launchpads are platforms that enable the launch of new projects in the DeFi ecosystem. These platforms offer tools and services that facilitate project launch, including fundraising, marketing, and community building. DeFi launchpads offer investors access to early-stage DeFi projects, enabling them to participate in the growth of the ecosystem while mitigating the risks associated with investing in new and untested projects.

How do DeFi launchpads work?

DeFi launchpads work by providing a range of services that facilitate the launch of new projects in the DeFi ecosystem. The process typically involves the following steps:

-

Submission of the project to the launchpad: The first step is to submit the project to a DeFi launchpad. This typically involves filling out an application form and providing details about the project's goals, technology, and team.

-

Evaluation and approval of the project: Once the project is submitted, it undergoes a thorough evaluation process to determine its feasibility, potential, and alignment with the launchpad's goals. If the project passes the evaluation process, it is approved for launch on the platform.

-

Token generation and distribution: After the project is approved, the launchpad generates and distributes tokens that represent ownership of the project. These tokens can be used for fundraising, voting, and other governance activities.

-

Fundraising through an initial coin offering (ICO) or initial exchange offering (IEO): With the tokens generated, the project can now launch a fundraising campaign through an ICO or IEO. This involves offering tokens to investors in exchange for funding.

-

Community building and marketing: Finally, the project team needs to build a community around the project and promote it to potential users and investors. This involves activities like social media marketing, content creation, and engagement with the community on various channels like Telegram and Discord.

Advantages of using DeFi launchpads for new projects

DeFi launchpads offer several advantages to new projects seeking funding and exposure. These advantages include:

-

Access to a wide range of services and tools: DeFi launchpads offer a suite of services that help new projects raise funds, build a community, and promote their products. This includes access to development resources, marketing tools, and other support services that would otherwise be expensive or difficult to obtain.

-

Exposure to a large audience of potential investors: Launchpads typically have a large user base of investors and traders who are actively looking for new investment opportunities. By launching through a DeFi launchpad, new projects can tap into this existing user base and potentially attract a large number of investors.

-

Reduced marketing and community-building costs: DeFi launchpads provide a ready-made platform for new projects to build a community around their product, reducing the need for expensive marketing campaigns and community-building efforts.

-

Increased credibility and legitimacy through association with reputable launchpads: By launching through a reputable DeFi launchpad, new projects can gain instant credibility and legitimacy in the eyes of potential investors and users.

-

Reduced time and cost to market: Launching a new DeFi project can be a time-consuming and costly process. By using a DeFi launchpad, new projects can accelerate the process of fundraising and community-building, allowing them to get to market faster and more cost-effectively.

Risks and challenges associated with using DeFi launchpads

-

High competition for launchpad spots

-

Potential for scams and frauds

-

Regulatory uncertainty in some jurisdictions

-

Limited control over the launchpad's token distribution process

-

Lack of transparency in the selection process for projects

Which method is better for launching a new project?

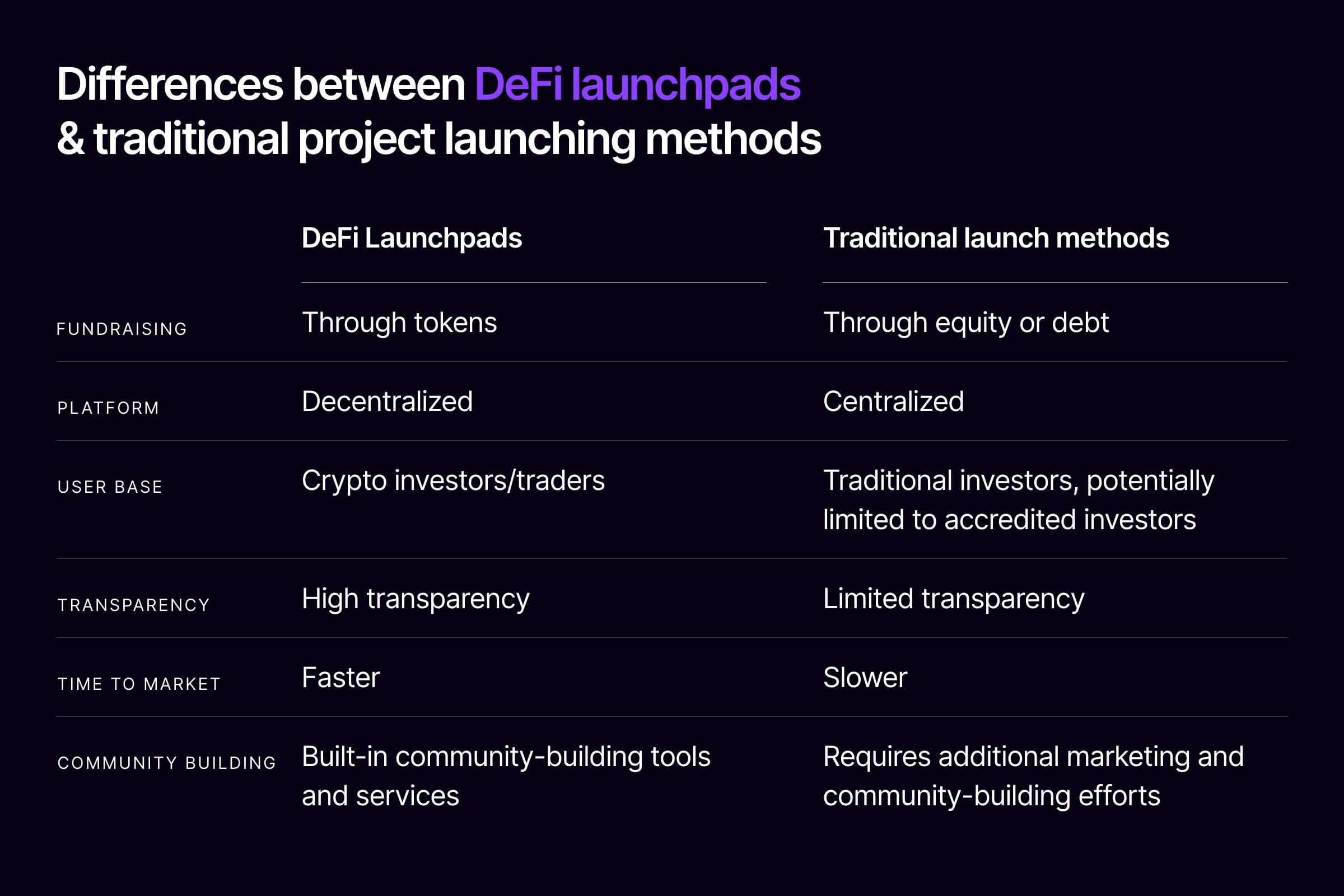

The choice between DeFi launchpads and traditional project launching methods depends on various factors such as the nature of the project, target audience, funding requirements, and timeline. DeFi launchpads offer a decentralized and community-driven approach that can provide exposure to a wider audience and potentially faster fundraising. On the other hand, traditional project launching methods may provide more tailored support and guidance, established networks, and a more predictable timeline. Ultimately, it's essential to evaluate the pros and cons of each approach and choose the one that aligns best with your project's goals and resources.

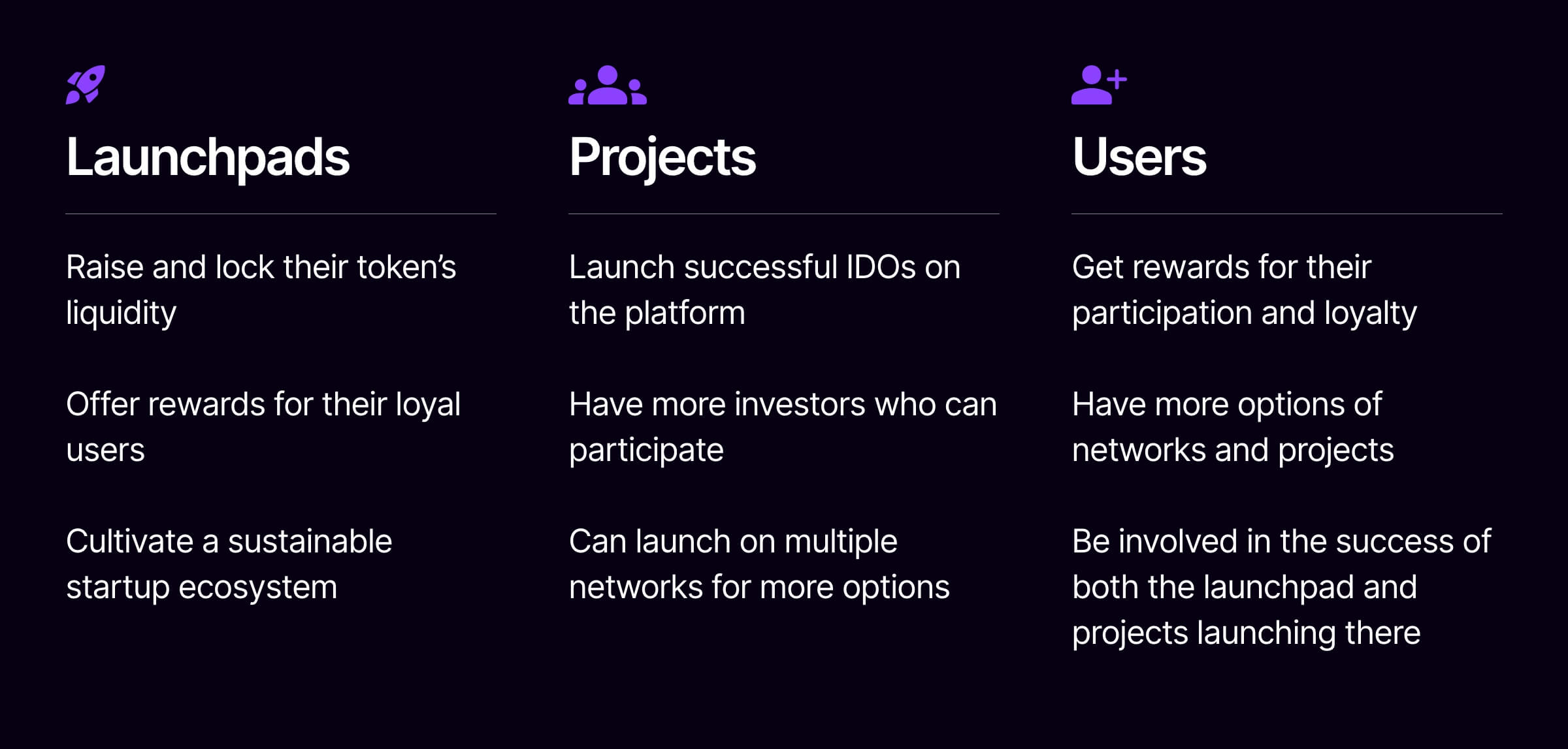

Popular DeFi Launchpads

Looking for a reliable Launchpad Development platform for your DeFi project? Check out these popular DeFi launchpads that offer a range of services to help new projects gain traction and funding.

-

Binance Launchpool: Binance's DeFi launchpad offers users the ability to farm new DeFi tokens and earn rewards in exchange for providing liquidity to new DeFi projects.

-

Poolz: Poolz is a cross-chain IDO launchpad that allows projects to raise funds by selling their tokens to early-stage investors.

-

DuckStarter: DuckStarter is a DeFi launchpad that provides users with access to pre-sale offerings of emerging DeFi projects.

-

TrustSwap: TrustSwap offers a range of DeFi launchpad services, including token sales, staking, and liquidity provision.

Case Studies of Successful Projects Launched Through DeFi Launchpads

-

DODO: DODO is a decentralized exchange that raised $5 million through an IDO on Binance Launchpool in 2020.

-

ChainGuardian: ChainGuardian, a blockchain-based game, raised $2 million through an IDO on Poolz in 2021.

-

OccamFi: OccamFi, a decentralized fundraising platform, raised $10 million through an IDO on DuckStarter in 2021.

-

Royale Finance: Royale Finance, a decentralized lending protocol, raised $1.45 million through an IDO on TrustSwap in 2020.

Analysis of the Impact of DeFi Launchpads on the Blockchain Industry

DeFi launchpads have significantly impacted the blockchain industry by providing new opportunities for emerging projects to raise funds and gain exposure. They have facilitated the growth of the DeFi ecosystem, driving innovation and collaboration. However, the increasing popularity of DeFi launchpads has also raised concerns about the risks associated with investing in early-stage projects, such as fraud and market manipulation. Overall, DeFi launchpads have played a vital role in the blockchain industry's development, and their impact is expected to continue as the industry evolves.

Finding the Right Fit: Selecting a Development Team for Your DeFi Venture

When it comes to starting a DeFi project, one of the most important decisions is choosing the right development team. If you're considering Launchpad Development Services for your project, it's critical to take into account various factors such as expertise in blockchain technology, experience in working with DeFi protocols and tools, security consciousness, effective communication, team size, and development methodology. Making the right choice is paramount for the success of the project.

Codezeros is a blockchain development company that offers comprehensive Launchpad Development solutions for the DeFi ecosystem. We have a team of experienced developers, architects, and consultants who can help you design, develop, and deploy your DeFi project. We follow best practices and employ industry-standard tools and frameworks to ensure the security, scalability, and reliability of your project. Additionally, we can assist with project ideation, whitepaper creation, token economics, and community building. With our expertise and guidance, you can launch a successful DeFi project that meets your business goals and satisfies your users' needs.

Conclusion

DeFi launchpads can be a viable option for starting a new project, especially for those who want to leverage the benefits of the blockchain ecosystem. They offer a range of services that can help startups raise capital, access a wide user base, and create a community-driven project. However, it is important to carefully consider the risks involved and evaluate the effectiveness of the launchpad before making a decision. Ultimately, the success of a project depends on several factors, including the team's capabilities, market demand, and adoption by users.

Post Author

As a distinguished blockchain expert at Codezeros, Paritosh contributes to the company's growth by leveraging his expertise in the field. His forward-thinking mindset and deep industry knowledge position Codezeros at the forefront of blockchain advancements.