SHARE THIS ARTICLE

How AI-Powered Market Makers Are Changing the DEX Landscape

In decentralized finance (DeFi), there is a growing interest in using artificial intelligence to manage data, guide trading decisions, and automate tasks once handled by humans. This trend, often referred to as AI in DeFi, is drawing attention from developers, traders, and anyone exploring cryptocurrency development. As this field expands, cryptocurrency exchange development is following suit by applying AI-based tools that may change how users trade and oversee digital assets.

Market makers are a vital part of any trading environment since they provide orders that keep trading pairs active. AI-powered market makers carry out this role with fewer guesswork and faster feedback loops. By relying on live data and smart algorithms, they can refine liquidity provision while reducing issues like slippage and inconsistent pricing. In the world of DEX development, this approach has the potential to simplify user experiences and lessen volatility in trading pairs.

In this article, we will walk through the mechanics of AI-driven market making, its influence on decentralized exchanges, and some common challenges that arise along the way. We will also touch on upcoming trends and possible opportunities for those interested in applying these methods.

Understanding AI-Powered Market Makers

Traditional AMMs vs. AI-Driven Market Makers

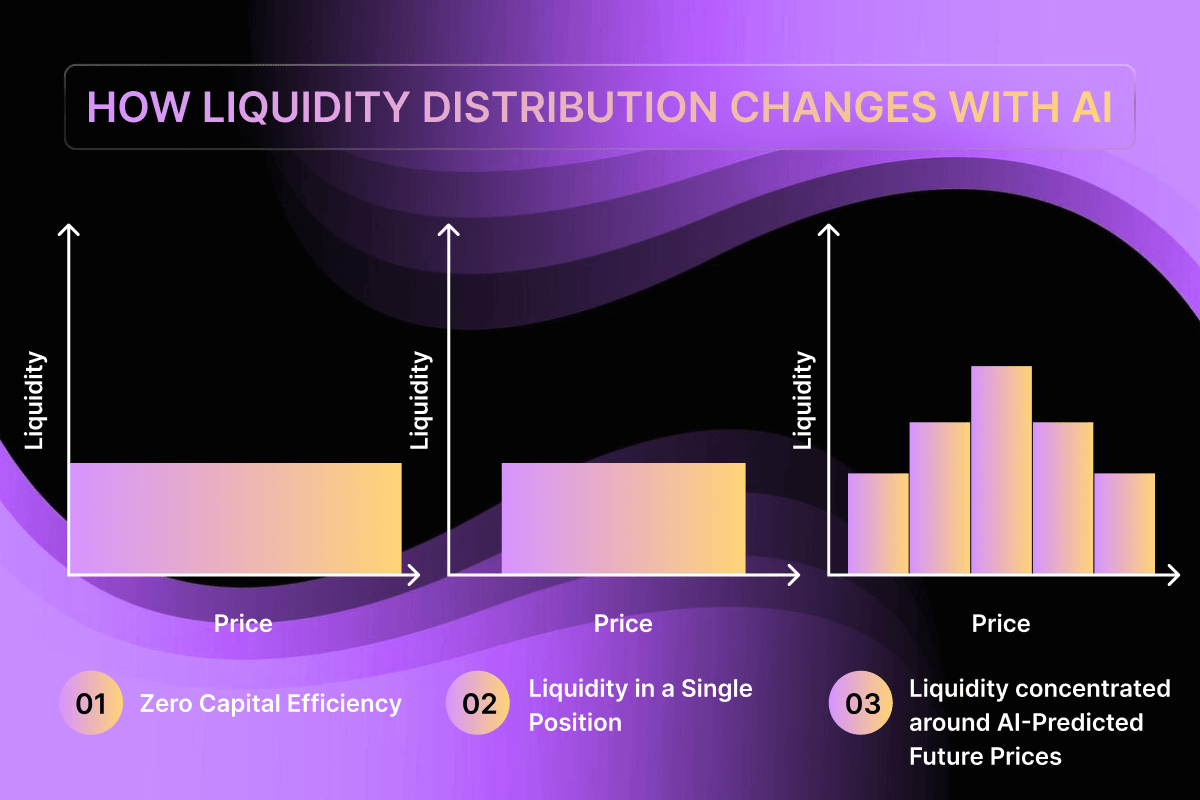

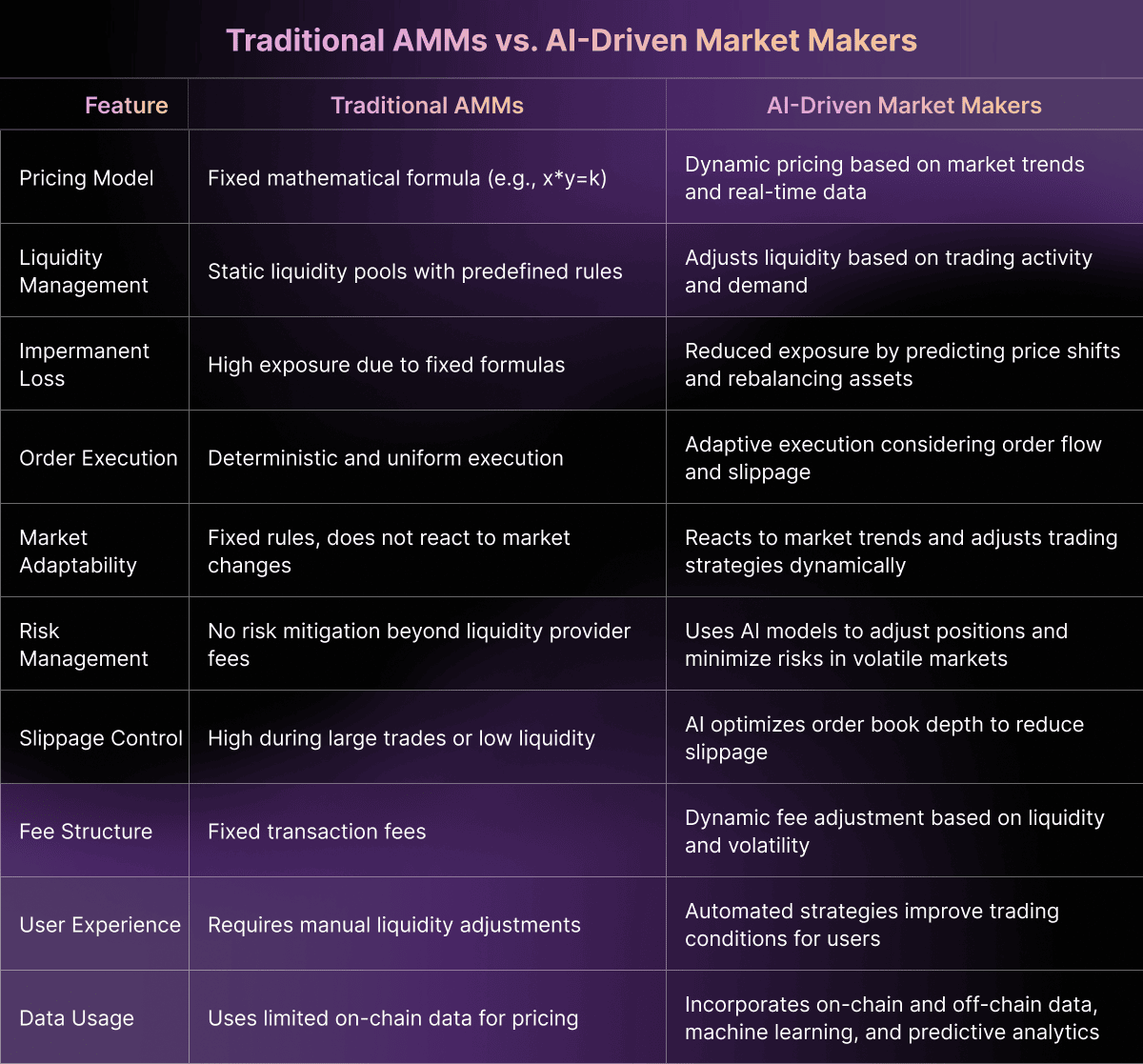

Automated Market Makers (AMMs), such as those used by Uniswap, rely on a fixed formula (often written as x*y=k) to set prices and manage liquidity pools. While this formula is easy to apply, it does not adjust for changes in trading behavior or sudden price swings. On the other hand, AI-driven approaches draw on algorithmic trading strategies and real-time market inputs to make continuous adjustments. This means they can track changes in trade volume or sentiment and adjust liquidity pools with fewer delays. By doing so, these AI-based strategies may help reduce impermanent loss and keep liquidity pools healthy even when markets shift rapidly.

The Core Benefits of AI in Liquidity Provision

-

Predictive Pricing

Machine learning models can look at on-chain data and other market signals to forecast price swings. This early insight allows AI to set buy and sell ranges with more precision.

-

Risk Management

Automated risk checks and position rebalancing can help curb large losses when the market moves in unexpected ways. If certain trades or pools seem unstable, AI can move liquidity or adjust positions based on pre-set guidelines.

-

Adaptive Strategies

AI can study how traders behave, then change its methods to align with current market activity. If user demand spikes for a certain token, AI can shift liquidity toward that token without needing manual input. This process is often called liquidity optimization since it aims to keep liquidity pools fluid and trades smoother.

Real-World Examples

Some AI-powered DEXs and market maker projects are already testing these ideas. Although this approach is still in its early stages, the examples below offer insight into what is being tried in the field of blockchain solutions.

Hummingbot

-

An open-source project that provides algorithmic trading strategies for cryptocurrency markets.

-

While not exclusively AI-focused, ongoing community efforts explore how machine learning might guide its market making bots.

Pionex Grid Bots

-

A centralized exchange platform offering AI-based grid bots for automated trading.

-

Even though it’s not a decentralized exchange, it shows how AI principles can improve automated strategies in live markets.

Fetch.ai’s DeFi Agents

-

Fetch.ai has developed agent-based tools that use machine learning to help users find better trade opportunities across different platforms.

-

Their system aims to optimize trading and liquidity allocation, showing the role AI can play in decentralized settings.

Technical Breakdown - How AI-Powered Market Makers Operate

Data Collection & Analysis

AI-powered market makers rely on a mix of big data and on-chain analytics to make informed decisions. They gather information from order books, price feeds, and oracle-based data to gain a complete view of current trading conditions.

-

On-chain analytics involves looking at transactions and liquidity changes recorded directly on the blockchain.

-

Off-chain analytics might include data from centralized exchanges or public sentiment.

These sources help develop predictive models that can spot short-term price changes and trading volume patterns, giving AI the figures it needs to act promptly.

Core AI/ML Algorithms and Models

Within the field of machine learning in crypto, there are a few approaches that stand out for market making tasks:

-

Reinforcement learning: This method adapts to changing conditions by rewarding certain decisions and punishing others, making it a fit for continuous adjustments to liquidity pools.

-

Neural networks: These models process large sets of historical data and look for complex patterns in trading behavior. They might watch price trends or user actions to refine strategies as markets move.

By mixing these techniques, AI-driven bots can react to sudden price swings or random demand shifts with fewer delays.

Smart Contracts & Execution Layer

Once the AI model makes its calls, the next step involves putting those decisions into action through smart contract development. These contracts run on blockchain networks like Ethereum and act as the final checkpoint for trades, liquidity transfers, and fee adjustments.

-

It’s important to follow strict guidelines during coding to avoid exploits such as MEV (Maximal Extractable Value) or flash loan attacks.

-

Some groups may use blockchain development services with a focus on security audits and robust testing to confirm that any automated moves the AI suggests are carried out responsibly and without unexpected costs.

This blend of real-time data, machine learning methods, and secure contract operations forms the core of how AI-powered market makers function in a live trading setting.

Impact on the DEX Landscape

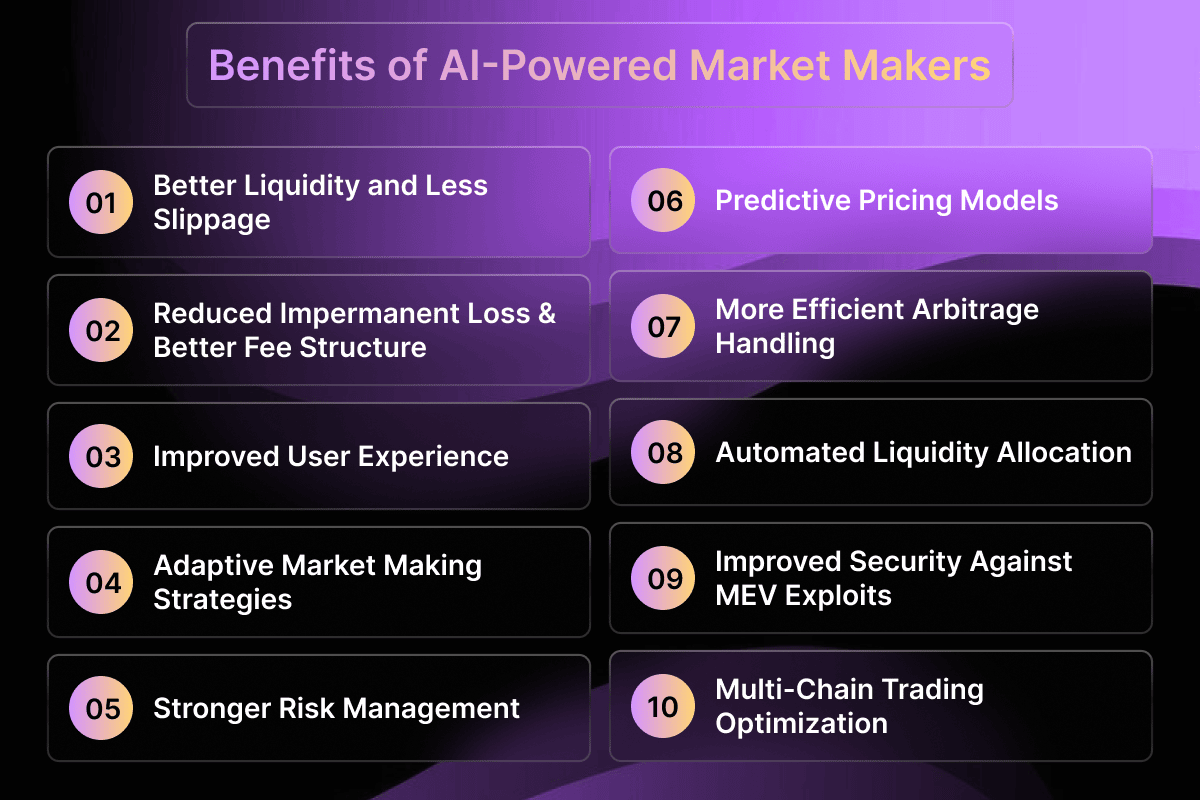

Better Liquidity and Less Slippage

AI-driven strategies can keep liquidity pools more stable by adjusting token balances based on real-time market signals. This approach supports slippage reduction, which helps traders avoid unexpected price jumps. Methods like order book optimization can also respond faster to supply and demand changes, providing a smoother trading experience for all users.

Reduced Impermanent Loss & Better Fee Structure

AI systems can watch shifts in token values and reposition assets quickly, cutting down the chances of impermanent loss. They can also use dynamic rules for transaction fees, increasing or lowering them to match current trading activity. This kind of model tends to benefit both liquidity providers and DEX operators, creating steady outcomes in yield farming while keeping costs in check for day-to-day users.

Improved User Experience (UX)

Many AI-driven tools focus on DEX user experience by giving traders a clearer view of market activity. Features like AI-based analytics dashboards can show price trends, while personalized trading insights highlight tokens or pairs that match a user’s past behavior. Real-time alerts can warn users of sudden price spikes or drops, and UI/UX in crypto keeps the trading interface straightforward. These additions fall under the idea of advanced trading tools, giving users more confidence as they place and track their trades.

Use Cases & Success Stories

DEX Platforms Tapping into AI

Some leading DeFi projects have begun trying out AI-based modules for liquidity management. In certain cases, these features are added to an AI-based DEX or built into existing systems that already serve a robust user base. For instance, a few experimental setups partner with AI startups to study how algorithmic bots might carry out real-time price checks and trading tasks. Such efforts support decentralized exchange development by showing potential ways to fine-tune liquidity or pricing without relying only on static models.

Institutional Adoption

Institutional investors in crypto are paying more attention to HFT in DeFi, exploring ways to profit from short-term market movements. AI-based algorithmic trading tools are of special interest for hedge funds and specialized trading desks that want to make use of deep liquidity. In some cases, these groups view liquidity as a service as a practical approach: they can subscribe to a platform or protocol that provides the needed liquidity and AI-powered tools. By doing this, they get more freedom to scale their trading operations while keeping manual processes to a minimum.

Key Challenges and Considerations

Security & MEV (Maximal Extractable Value)

MEV protection is a major focus in DeFi security since front-running and sandwich attacks can cause unfair losses to traders. AI systems can watch mempool data for suspicious patterns and redirect trades when something seems off. Certain groups also turn to Flashbots or private relays that allow them to sidestep the public mempool, reducing the risk of front-runs and other exploits.

Regulatory Compliance

Global crypto regulations continue to influence how AI-based DEXs operate. Rules such as MiCA (EU), SEC guidelines in the United States, and UAE’s VARA shape how tokens are listed, how trades are recorded, and what reporting steps apply. Some protocols introduce AML/KYC procedures to match global compliance standards, especially when serving institutional clients. Striking a balance between a user-driven system and meeting legal requirements is a major consideration for project teams.

Data Reliability & Oracle Dependence

Accurate data is central to AI modeling in DeFi. Projects that rely on blockchain oracles like Chainlink or other decentralized data feeds must stay alert for delays or possible tampering. If an oracle provides flawed pricing, AI-driven trades might produce unexpected results. Some developers run multiple oracles or use fallback systems to cut down on the chance of errors and keep trading methods consistent across shifting market conditions.

How AI + DEX Are Evolving Together

Multi-Chain & Layer-2 Integrations

Projects that use AI are looking at ways to bring cross-chain liquidity under one roof. Efforts like LayerZero help assets move across different blockchains, boosting the reach of AI trading tools. Meanwhile, Optimistic Rollups and other Layer-2 networks could cut transaction fees and speed up trades. AI systems that watch multiple chains might open the door to more advanced strategies, where traders move assets quickly based on market signals from different networks.

Growth in Advanced DeFi Derivatives

As more users explore on-chain futures or options, there is growing interest in products like perpetual DEX, futures on-chain, and options trading. AI can study market data from various sources and come up with pricing methods for these complex instruments. By keeping track of volatility, supply, and demand, AI-driven models may help traders set orders with fewer delays. Over time, these developments might expand beyond simple spot trading and bring new possibilities to the DeFi space.

Mainstream Adoption

A user-friendly approach, plus more robust features, may guide mass adoption of AI-powered trading tools. As a result, traditional investors might see DeFi as a workable choice rather than a novelty. Providers of blockchain consulting, including Codezeros, can step in to design solutions that meet the needs of both small traders and larger funds. This process could help more people feel at ease with DeFi and create steady growth in AI-based trading over the long term.

How Codezeros Can Help

Codezeros’ Expertise in AI and Blockchain

As one of the blockchain solution providers that stay current with technical trends, Codezeros has been part of projects where AI integration meets cryptocurrency exchange development services. Our team has worked on custom DEX solutions and created AI-based components that track market conditions. We also look at scalability, security, and user experience when shaping these tools, making sure they fit the goals of each client.

End-to-End Development Services

We deliver more than just coding. Our team covers the full cycle, from high-level ideas to maintenance. For instance, we handle smart contract development for platforms like Ethereum, where attention to detail is crucial for reliable execution.

-

DEX audits: We run rigorous checks to spot possible flaws and confirm that the system lines up with best practices.

-

AI-ML consulting: Our approach includes reviewing data sources, picking the right algorithms, and mapping out how AI can function in a live trading system.

Every step is designed to keep projects stable and consistent over time.

Working with Codezeros

We invite you to get in touch with us to discuss how AI-driven solutions could fit your plans. As a blockchain consulting company, we know the value of clear roadmaps, efficient development, and support after launch. Whether you want a quick conversation or need a detailed plan, you can contact Codezeros to start the process or request a quote. Our goal is to make sure clients have the resources and support they need to roll out an AI-powered market maker or any other advanced trading feature.

Final Thoughts

AI-based trading methods have introduced new ways to operate an AI-powered DEX. These methods rely on machine learning to track real-time data and respond to sudden market changes. While challenges like security risks and regulatory requirements still need close attention, the future of cryptocurrency exchanges seems to be leaning toward more dynamic solutions. In terms of innovation in DeFi, the long-term potential includes improved pricing, better liquidity, and safer user experiences.

Adopting these AI-driven approaches may set the stage for what some call (transforming DeFi) and guide next-gen cryptocurrency exchanges toward more practical solutions. Businesses that explore these options have a chance to stay current in a fast-moving market. If you’re interested in shaping a project around these ideas, take a moment to check out Codezeros. You can contact Codezeros to discuss how AI can fit into your DEX plans.

Post Author

As a distinguished blockchain expert at Codezeros, Paritosh contributes to the company's growth by leveraging his expertise in the field. His forward-thinking mindset and deep industry knowledge position Codezeros at the forefront of blockchain advancements.

Build Smarter Market Makers for Decentralized Trading with Codezeros.

Tap into AI-driven AMMs that dynamically adjust liquidity pools and optimize bid-ask spreads in real-time. Codezeros specializes in self-learning algorithms for superior capital efficiency and reduced impermanent loss in AMM-based DEXs.