SHARE THIS ARTICLE

How Self-Regulating Cryptocurrencies Could Shape the Future of Finance

Regulation in the cryptocurrency industry is crucial – be it to protect investors, prevent illicit activities, and ensure the long-term stability and viability of this emerging financial ecosystem. While governments around the world have begun to introduce various regulatory frameworks, the pace of innovation in the crypto space often outpaces the ability of policymakers to keep up. This is where self-regulation in the cryptocurrency industry can play a crucial role in shaping the future of finance.

Self-regulation, where industry participants establish and enforce their own standards and best practices, has the potential to complement government oversight and address the unique challenges posed by the decentralized nature of cryptocurrencies. By establishing a culture of responsibility and accountability, self-regulation can help build trust, promote transparency, and facilitate the sustainable growth of the cryptocurrency industry.

Volatility and Centralized Control in Traditional Crypto

The current state of cryptocurrencies, despite their innovative potential, is marred by a significant challenge of volatility. The value of popular cryptocurrencies like Bitcoin can fluctuate dramatically, leading to wild swings in investor sentiment and obstructing their widespread adoption as a reliable medium of exchange.

Several factors contribute to this volatility. One significant factor is the speculative nature of the cryptocurrency market. Cryptocurrencies are still a relatively young asset class, and their value is heavily influenced by investor sentiment and market hype. This can lead to periods of irrational exuberance followed by sharp corrections, exacerbating volatility.

Another factor is the evolving nature of regulatory environments. Uncertainty and frequent changes in regulations across different jurisdictions can create instability in the market, leading to sudden price swings. News of regulatory crackdowns or endorsements can have an outsized impact on market sentiment and, consequently, on the prices of cryptocurrencies.

Beyond volatility, another concern lies with the issue of centralized control in some cryptocurrency exchanges. These platforms, which facilitate the buying and selling of cryptocurrencies, can sometimes resemble traditional financial institutions. A lack of transparency and potential manipulation within these exchanges can undermine the core principles of decentralization that underpin cryptocurrency development services.

Self-Regulating Cryptocurrencies and Algorithmic Adjustments

Self-regulating cryptocurrencies are digital assets that are designed to operate on a set of pre-defined rules encoded within their blockchain, utilizing smart contracts and decentralized governance mechanisms to achieve a level of self-regulation that traditional financial systems cannot match.

At the core of self-regulating cryptocurrencies are algorithmic mechanisms that automatically adjust various parameters based on real-time network conditions and pre-determined criteria. These adjustments help maintain stability, efficiency, and user engagement, making these cryptocurrencies more adaptable and resilient to market fluctuations.

One key aspect of these mechanisms is the ability to dynamically adjust the total supply of the cryptocurrency. For instance, if the network detects a surge in demand, the algorithm might automatically increase the block reward (the incentive for mining new coins) to gradually introduce more coins into circulation. Conversely, during periods of low activity, the reward might decrease to prevent excessive inflation. This helps to maintain a balance between supply and demand, thereby reducing volatility.

Another important feature is the adjustment of transaction fees based on network congestion. When the network experiences high transaction volumes, fees can be automatically raised to incentivize miners to prioritize processing transactions. During periods of low traffic, fees can be lowered to encourage more user activity. This dynamic fee adjustment helps to manage network congestion and ensure that transactions are processed efficiently.

Prominent examples of self-regulating cryptocurrencies include Dash and Nano (formerly known as RaiBlocks). Dash employs a unique governance model and self-funding mechanism that allows for continuous development and community-driven improvements. Its network dynamically adjusts block rewards and transaction fees to maintain stability. Nano, on the other hand, focuses on providing fast and feeless transactions through its innovative block-lattice architecture, where each account has its own blockchain, and consensus is achieved through delegated proof-of-stake (DPoS).

Exploring Self-Regulation Mechanisms

Unlike their volatile counterparts, self-regulating cryptocurrencies tap into a toolbox of built-in mechanisms to achieve stability and efficiency. Here are some key self-regulation mechanisms that these cryptocurrencies employ.

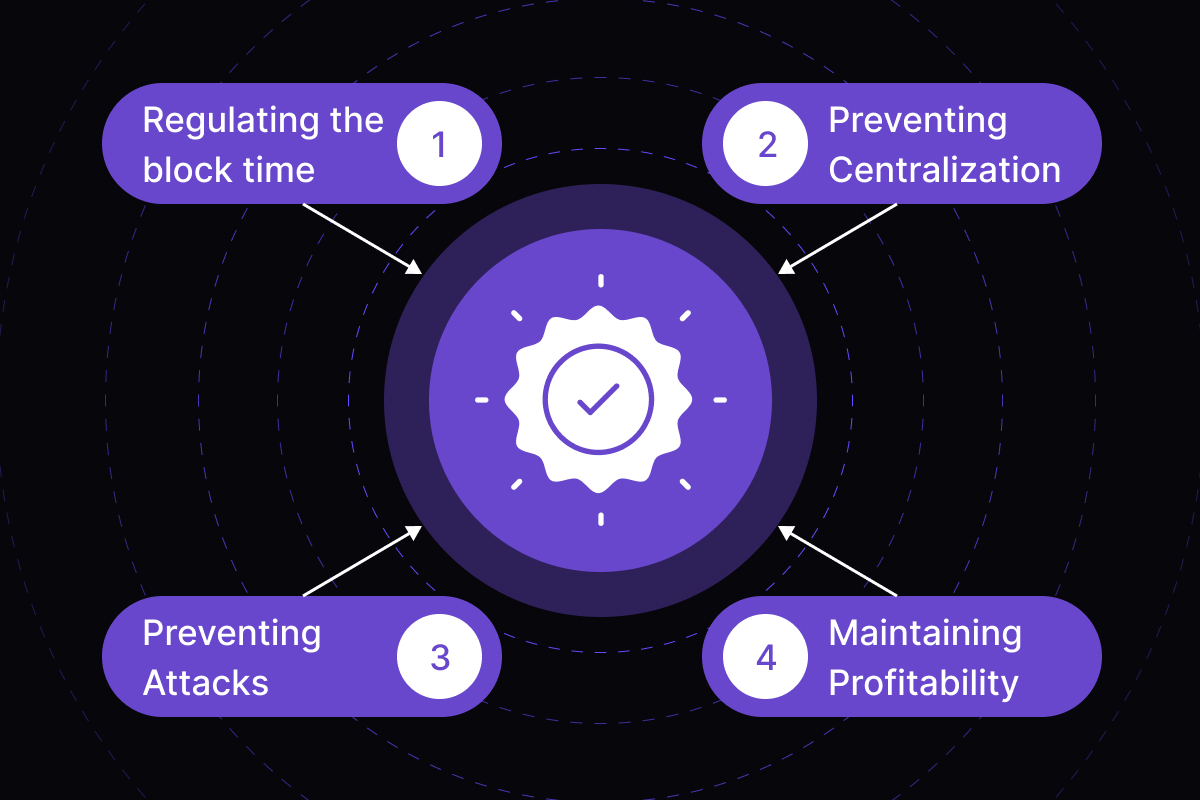

Dynamic Block Difficulty Adjustments

One of the key self-regulation mechanisms is dynamic block difficulty adjustments. In many blockchain networks, block difficulty refers to the complexity of the puzzles that miners must solve to add a new block to the blockchain. This difficulty level is adjusted periodically to make sure that blocks are produced at a consistent rate, regardless of the number of miners or their collective computing power.

For example, in the Bitcoin network, the block difficulty is adjusted approximately every two weeks. If blocks are being mined faster than the intended 10-minute interval, the difficulty increases, making it harder to mine subsequent blocks. Conversely, if blocks are being mined too slowly, the difficulty decreases. This dynamic adjustment helps maintain a steady rate of block production, contributing to network stability and predictability.

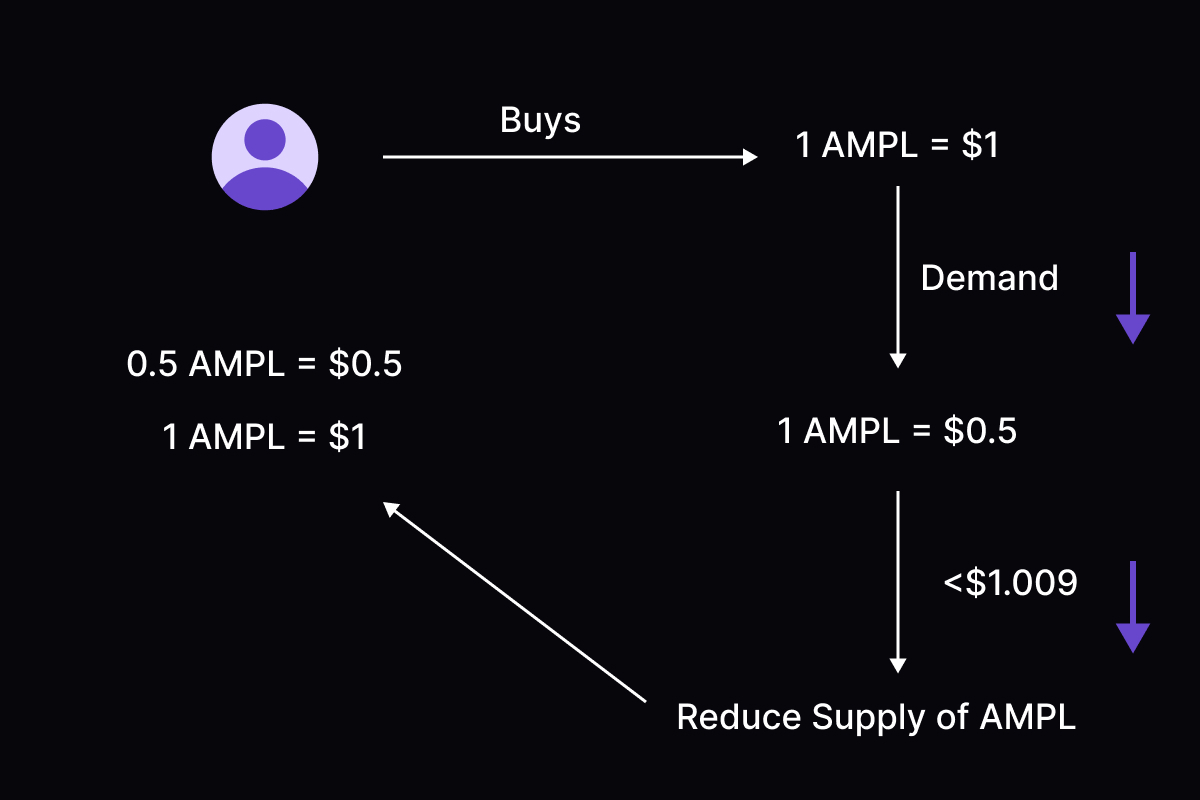

Algorithmic Control of Coin Supply

Another essential mechanism is the algorithmic control of coin supply. This involves adjusting the total supply of a cryptocurrency based on predefined rules to manage inflation and demand.

Take Ampleforth (AMPL) as an example. Ampleforth employs a unique rebasing mechanism that automatically adjusts its supply based on the token's price relative to a target value (usually $1). If the price of AMPL is above $1, the supply increases, distributing additional tokens to all holders. If the price falls below $1, the supply decreases, effectively reducing the number of tokens each holder possesses. These adjustments help stabilize the token's price and manage inflation, creating a more predictable monetary policy.

Fee Adjustments Based on Network Congestion

Fee adjustments based on network congestion are another critical self-regulation mechanism. Transaction fees in many cryptocurrencies can vary depending on network activity levels. During periods of high transaction volume, fees may increase to prioritize transactions, encouraging miners to process transactions promptly. Conversely, during low activity periods, fees may decrease to stimulate more transactions and keep the network active.

One of Ethereum's recent upgrades, known as EIP-1559, introduced a new fee structure to manage network congestion more effectively. This upgrade splits the transaction fee into a base fee, which adjusts dynamically based on network congestion, and a priority fee, which users can include to expedite their transactions. The base fee is burned (removed from circulation), while the priority fee goes to miners. This mechanism helps balance supply and demand for block space, promoting smoother and more predictable transaction processing.

Potential Benefits and Use Cases

Self-regulating cryptocurrencies offer several potential benefits, making them an attractive option for a variety of applications. Here, we highlight some of these benefits and explore specific use cases where self-regulating cryptocurrencies can make a notable impact.

Increased Transparency & Traceability

Self-regulating cryptocurrencies improve transparency and traceability by tapping into blockchain technology. Each transaction is recorded on a public ledger, creating an immutable audit trail that is accessible to anyone. This reduces the risk of fraud and enhances accountability.

For instance, in supply chain management, self-regulating cryptocurrencies can be used to track the provenance of goods. By recording each step of the supply chain on the blockchain, businesses can verify the authenticity of products and trace their origins, improving transparency and reducing the risk of counterfeit goods.

Better Security & Stability

Self-regulating cryptocurrencies can be programmed to resist hacks and manipulation through effective consensus mechanisms and smart contracts. Algorithmic adjustments help maintain stability, preventing sudden fluctuations that can lead to security vulnerabilities.

In decentralized lending and borrowing platforms, self-regulating cryptocurrencies can adjust collateral levels automatically based on market conditions. This reduces the risk of under-collateralization and maintains and improves the security of the platform, protecting both lenders and borrowers.

Democratization of Finance

Self-regulation can create more inclusive financial systems by removing the need for central intermediaries. This democratizes access to financial services, allowing individuals and businesses to participate in the global economy without relying on traditional banks.

Decentralized lending and borrowing platforms, such as Aave and Compound, allow users to lend and borrow assets without intermediaries. These platforms use self-regulating mechanisms to adjust interest rates based on supply and demand, creating a fair and transparent lending environment accessible to everyone.

Despite speculation, self-regulating cryptocurrencies offer exciting use cases that can transform various sectors.

Decentralized Lending & Borrowing Platforms

Self-regulating cryptocurrencies can revolutionize decentralized finance (DeFi) by providing a stable and secure foundation for lending and borrowing platforms. These platforms use algorithmic adjustments to set interest rates and manage collateral so that loans are adequately backed and the risk of defaults is minimized.

For example, MakerDAO uses its stablecoin, DAI, to facilitate decentralized lending. DAI is pegged to the US dollar and maintained through a system of collateralized debt positions (CDPs). The supply of DAI is adjusted algorithmically to maintain its peg, providing a stable currency for borrowers and lenders.

Automated Market Making and Algorithmic Trading

Self-regulating cryptocurrencies can boost automated market making and algorithmic trading by adjusting liquidity and trading parameters in real-time. This allows markets to remain liquid and efficient, even during periods of high volatility.

Uniswap, a decentralized exchange, uses an automated market maker (AMM) model that relies on liquidity pools. The platform's smart contracts automatically adjust prices based on supply and demand, providing continuous liquidity and reducing the impact of large trades on price stability.

Supply Chain Management and Provenance Tracking

In supply chain management, self-regulating cryptocurrencies can provide a transparent and secure way to track the movement of goods. By recording each transaction on the blockchain, businesses can verify the authenticity of products and trace their origins.

For example, VeChain uses blockchain technology to track products throughout the supply chain. By assigning unique identifiers to each product and recording their journey on the blockchain, VeChain increases transparency and reduces the risk of counterfeit goods, making sure consumers receive genuine products.

Technical Challenges & Considerations

While self-regulating cryptocurrencies offer exciting possibilities, it's important to acknowledge the technical challenges they face.

Scalability Hurdles

Many current blockchain protocols struggle to handle large volumes of transactions. This can lead to slow processing times and high fees, hindering their ability to compete with traditional financial systems. However, advancements like layer-2 scaling solutions and alternative consensus mechanisms are actively being explored to overcome these limitations.

Smart Contract Vulnerabilities

Smart contracts, the foundation of self-regulation, are susceptible to vulnerabilities if not designed and audited carefully enough. Exploits of these vulnerabilities can lead to considerable financial losses. The ongoing development of secure coding practices and efficient smart contract auditing processes are crucial to eliminating these risks.

The Decentralization Dilemma

Achieving true decentralization remains a complex task. While self-regulating mechanisms aim to distribute power, governance models within these cryptocurrencies can still evolve into centralized structures. Finding the right balance between efficient governance and maintaining a decentralized ethos is an ongoing challenge for developers.

Future Developments & Regulations

As self-regulating cryptocurrencies continue to mature, several key developments and regulatory considerations are set to shape their future.

Integration with Artificial Intelligence (AI)

One of the most promising future developments in self-regulating cryptocurrencies is the integration with Artificial Intelligence (AI). By harnessing AI, these cryptocurrencies can achieve even more dynamic and efficient rule enforcement. AI algorithms can analyze large datasets in real-time, allowing for more accurate adjustments to supply, transaction fees, and other parameters based on complex market conditions.

For instance, AI could be used to predict market trends and adjust the coin supply or transaction fees preemptively to mitigate potential volatility. This would improve the stability and robustness of self-regulating cryptocurrencies, making them more resilient to market fluctuations and better suited for widespread adoption.

Interoperable Ecosystems

Another significant development is the increasing focus on interoperability between different self-regulating blockchain networks. Currently, many blockchain networks operate in isolation, limiting their ability to interact and share data effectively. Future advancements aim to bridge these gaps, allowing self-regulating cryptocurrencies to interact and transact across multiple networks.

Interoperability protocols, such as Polkadot and Cosmos, are already working towards creating a more interconnected blockchain ecosystem. By facilitating effective communication and transactions between different blockchain networks, these protocols can improve the utility and flexibility of self-regulating cryptocurrencies, promoting greater innovation and adoption.

Regulations

Governments around the world are still grappling with how to regulate cryptocurrencies, including self-regulating ones. While regulations can provide clarity and stability, overly restrictive measures could hinder innovation and adoption. The future likely lies in a collaborative approach where developers and regulators work together to establish a framework that encourages responsible development while protecting consumers.

Final Takeaway

As cryptocurrencies advance, using self-regulating mechanisms can provide better stability, security, and transparency. At WDCS Technology, we specialize in creating advanced blockchain-based fintech solutions to meet your specific needs.

If you want to implement self-regulating algorithms, improve blockchain network interoperability, or integrate AI for dynamic rule enforcement, our team is here to help.

Contact us today to learn more about our blockchain development services and how we can help you use self-regulating cryptocurrencies to transform your business. Visit our website or reach out directly to speak with one of our experts.

Post Author

With a genuine love for all things blockchain, Jay is one of the Blockchain Enthusiasts and Consultants at Codezeros. With a fresh and innovative perspective on the world of blockchain, Jay provides strategic guidance and implementation support to clients across diverse industries and helps them unlock new opportunities.

Harness our blockchain solutions to empower your crypto project.

Seeking a competitive edge in crypto? Our blockchain expertise helps you build innovative self-regulating crypto solutions.