SHARE THIS ARTICLE

Restaking and Liquid Restaking Tokens (LRTs): The Future of Blockchain Staking

In the early days of proof-of-stake blockchains, staking was simple. You locked up your tokens, helped secure the network, and earned a reward in return. But as the ecosystem has matured, so have the expectations around capital efficiency.

Today, staking isn’t just about locking and earning. It’s about how much more you can do with the same capital. That’s where restaking comes in.

Restaking lets users take their already staked assets and put them to additional use—securing other protocols, earning new rewards, or participating in different networks at once. It’s a smart way to reuse staked capital without having to unstake or start from scratch.

And now, with Liquid Restaking Tokens (LRTs) entering the scene, things are getting even more interesting. LRTs give users access to the value of their staked tokens while still keeping them active in the restaking process. It’s a clever workaround to the old “locked and idle” problem.

This evolution in staking isn’t just good for users—it’s a huge area of interest for developers too. As restaking grows, blockchain development teams are stepping in to build the underlying protocols, smart contracts, and infrastructure that make it all possible.

What Is Restaking?

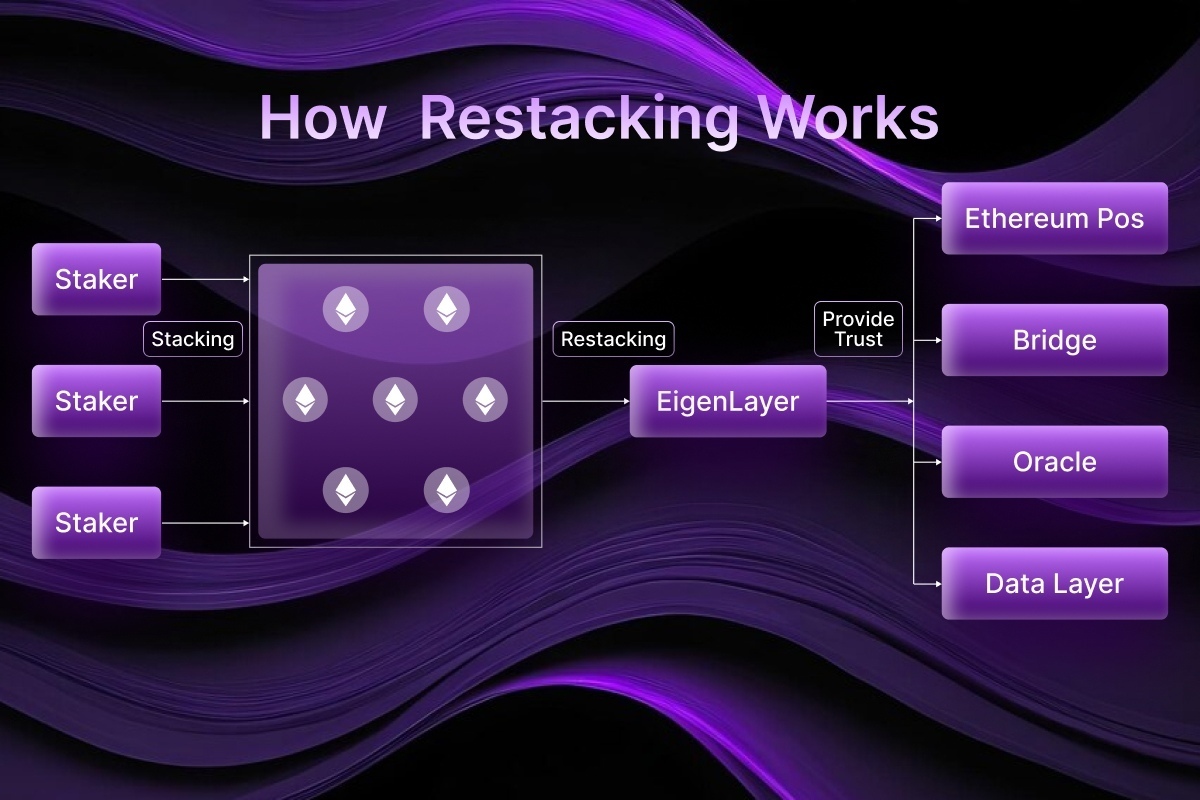

Restaking is a fairly new concept in the world of blockchain, but it’s picking up momentum quickly. At its core, restaking means taking assets that are already staked and putting them to work again—this time to help secure additional networks or services on top of the original one.

Let’s say you’ve staked tokens on Ethereum. Normally, those tokens would stay locked there, doing one job: helping keep Ethereum secure. With restaking, you can take those same staked tokens and use them in another protocol without having to withdraw or move them. This second layer of use opens up new opportunities for both users and developers.

One of the main projects leading this movement is EigenLayer. It’s built on Ethereum and allows users to restake their ETH or liquid staking tokens (like stETH or rETH) to support other modules or applications. The idea is to provide shared security to smaller protocols that don’t have their own large validator sets.

This approach brings a few clear benefits. First, it helps with staking rewards optimization. Instead of earning rewards from just one network, users can now earn from multiple sources using the same capital. Second, it improves blockchain security across the board. Protocols can tap into the security of an existing network without having to build their own from scratch. And third, it introduces the idea of layered consensus, where multiple services rely on the same trust layer, reducing redundancy in the system.

In short, restaking is about making better use of what’s already there. It’s a step toward more efficient and flexible staking models that work across different parts of the blockchain ecosystem.

Liquid Restaking Tokens (LRTs) Explained

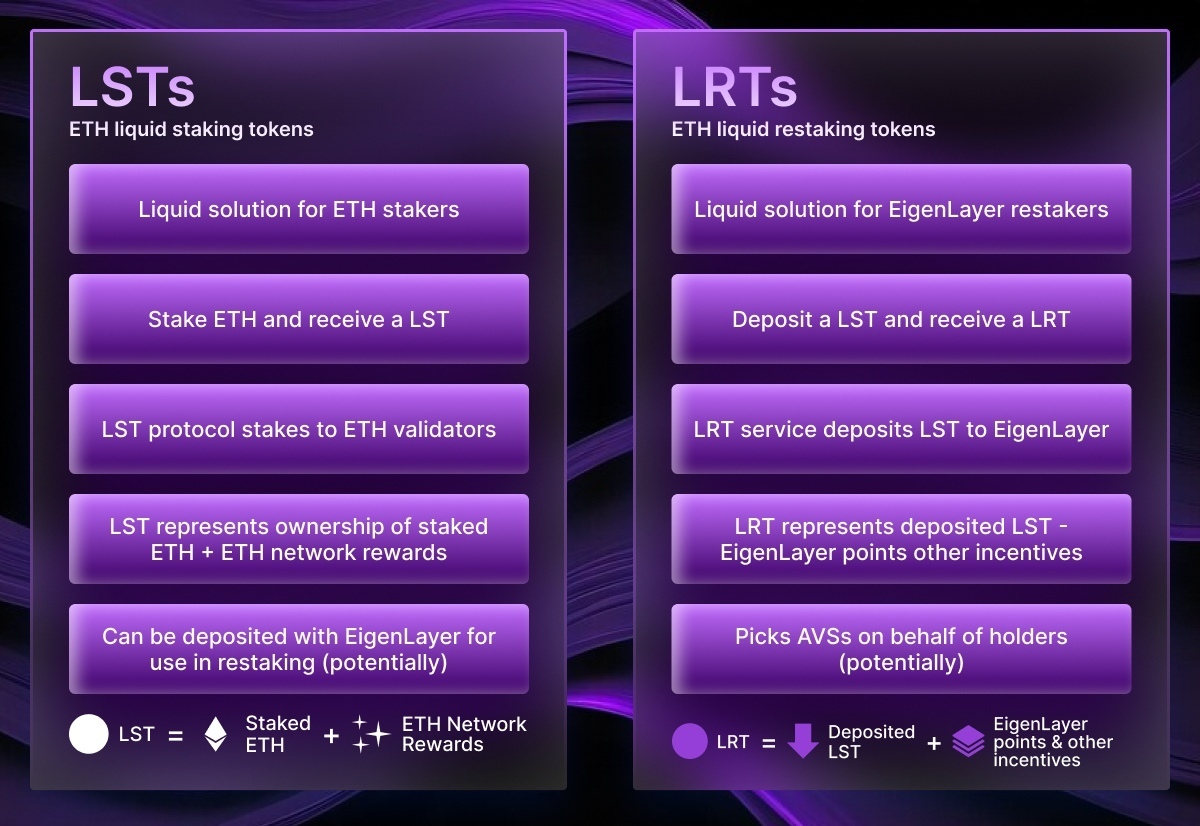

If restaking is about reusing staked assets, Liquid Restaking Tokens (LRTs) take that idea a step further. They give users a way to access the value of their restaked assets without having to wait or unlock anything.

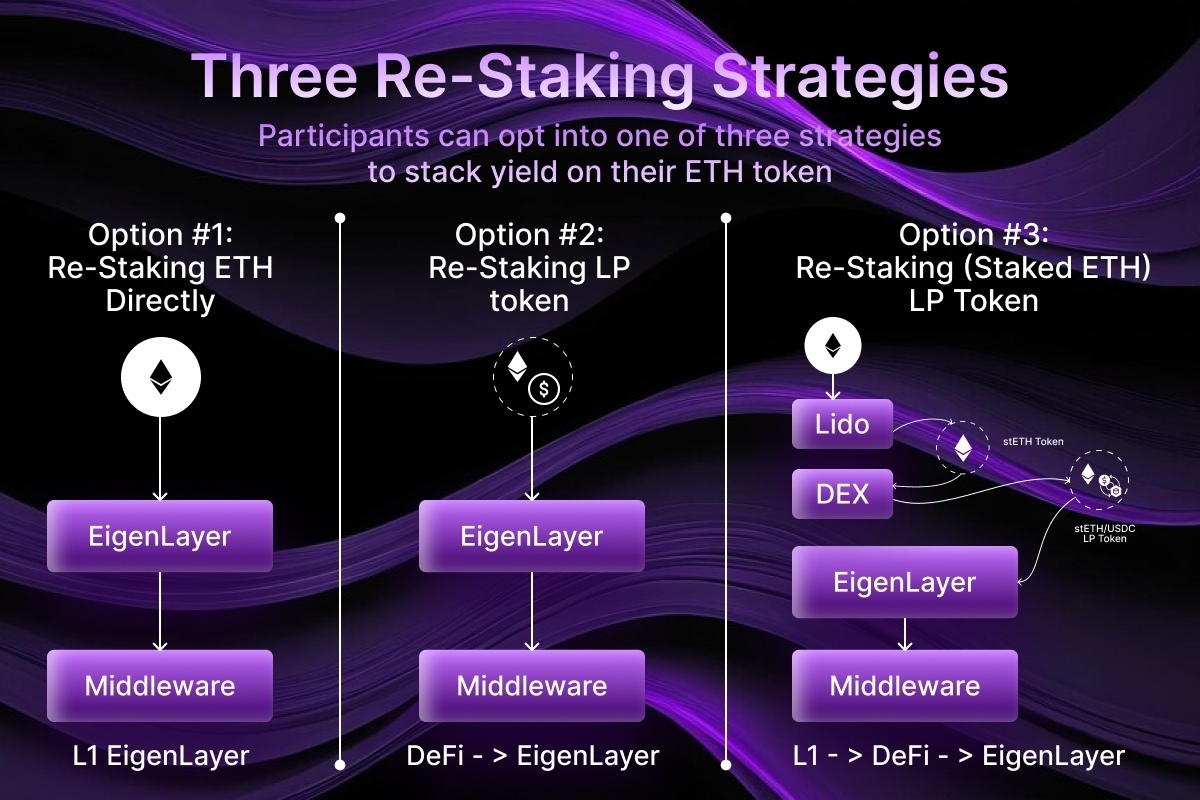

You might already be familiar with Liquid Staking Tokens (LSTs). These are tokens you receive when you stake assets through platforms like Lido or Rocket Pool. They represent your stake and allow you to keep using that value elsewhere—whether it’s trading, providing liquidity, or lending.

LRTs build on this model, but with restaking in mind. Instead of just representing a regular stake in a single network, an LRT reflects a restaked position that might be securing multiple protocols at once. That means the token could be earning rewards from more than one place.

This opens up new possibilities in liquid staking within DeFi. With an LRT, you can:

-

Join liquidity pools and farm rewards

-

Use the token as collateral in lending platforms

-

Vote in governance systems

-

Trade it freely, just like any other liquid asset

A few emerging protocols are already working in this space. Projects like EtherFi, Renzo, and Karak are exploring different models of liquid restaking. Each takes a slightly different approach, but they all aim to give users more flexibility and control over their staked capital.

In simple terms, LRTs allow you to stay active in staking while still being able to move, use, and earn from your assets across the broader DeFi ecosystem.

Key Benefits of LRTs in the DeFi Ecosystem

The rise of Liquid Restaking Tokens (LRTs) isn’t just a technical upgrade—it’s unlocking real utility across the DeFi space. By turning restaked positions into tradable, usable assets, LRTs bring several meaningful benefits to both users and builders.

Liquidity for Restaked Assets

Traditionally, staking meant locking up assets for a fixed period. Even with liquid staking, access to funds was often limited to a single-layer use case. LRTs change that by offering full liquidity for restaked assets, giving users the ability to move their capital while it continues to earn rewards.

Better Use of Capital

One of the main benefits of liquid restaking tokens is how they open up multiple income streams from the same token. You’re not just earning staking rewards—you’re also contributing to the security of other protocols and potentially earning there as well. It’s a more efficient use of capital, especially for active DeFi users looking to make the most of their holdings.

New Composability in DeFi

Because LRTs are tokenized, they can be plugged into all kinds of DeFi staking solutions. You can add them to liquidity pools, use them as collateral, or trade them like any other ERC-20 token. This kind of composability means developers can build entirely new financial products around restaking—layered yield strategies, structured products, even cross-chain staking interfaces.

From a broader perspective, LRTs are shaping a new category of restaking DeFi use cases, one where capital doesn’t sit idle and where security, liquidity, and yield can all work together.

Challenges and Risks of Restaking

Restaking opens up exciting possibilities, but it also comes with a few important trade-offs. Like most things in DeFi, more flexibility often means more complexity—and that brings new risks that both users and developers need to keep in mind.

Smart Contract Risk Across Layers

Restaking introduces additional layers of logic and interaction between protocols. If one contract fails or behaves unpredictably, it can affect all the systems built on top of it. These smart contract vulnerabilities aren’t new, but the risk multiplies when the same capital is used across different layers. Auditing becomes more important, and so does how protocols handle updates and governance.

Centralization Pressure on Validators

If multiple protocols rely on the same set of restakers or node operators, it creates a potential centralization threat. The more influence these restakers have, the more critical they become. A single group gaining too much control weakens the decentralized nature of the ecosystem. Over time, this could lead to validator-level power dynamics that resemble those seen in traditional systems.

Overleveraging and Cascading Failures

Using one asset across many protocols sounds efficient, but it can easily lead to overleveraging. If a major restaking provider goes down or faces a critical exploit, the damage could ripple through other connected protocols. This kind of dependency increases the risk of cascading failures, which could threaten not just users' funds, but the scalability and resilience of the blockchain networks involved.

These restaking risks don’t mean the model is flawed—it just means that, like most innovations in crypto, proper design, risk controls, and transparency are essential to long-term stability.

The Role of Blockchain Developers in Building Restaking Protocols

Restaking may look simple on the surface, but what happens behind the scenes is anything but. Building these systems requires deep technical expertise—not just in blockchain mechanics, but in security, scalability, and protocol design.

This is where experienced blockchain development services come in.

A strong restaking model needs more than a few smart contracts. It needs a well-thought-out staking protocol architecture that considers everything from validator incentives to network-level interactions. Developers must design for flexibility, without compromising on safety. That includes planning for how tokens are issued, tracked, and integrated with other systems in DeFi.

One of the most important aspects is security. With restaking, funds often move through multiple contracts and layers. Each interaction is a potential point of failure. Without proper smart contract development and rigorous auditing, the risks multiply fast. That’s why layered security, modular testing, and permission control are key areas of focus during development.

At Codezeros, we’ve worked on various custom blockchain solutions, including staking platforms and DeFi protocols. For teams looking to launch a restaking model or build support for Liquid Restaking Tokens, our experience in protocol design, contract auditing, and multi-chain development can help bring those ideas to life—securely and efficiently.

For restaking to grow into a reliable and scalable part of the blockchain ecosystem, it needs a strong technical foundation. That work starts with the developers.

LRTs and Crypto Exchanges: Opening Up New Opportunities

As Liquid Restaking Tokens (LRTs) become more common in DeFi, they’re also starting to catch the attention of centralized platforms—especially crypto exchanges. With the right tools in place, exchanges can integrate LRTs into their systems and open up a range of new products for users.

For starters, cryptocurrency exchange development services are now looking at how to list LRTs as tradeable assets. By adding new trading pairs that include LRTs, exchanges give users access to tokens that represent active yield positions, not just static assets. This unlocks more liquidity and brings a new class of assets into regular trading activity.

There’s also room to introduce staking-as-a-service features built around LRTs. Instead of asking users to figure out restaking on their own, exchanges can offer simplified flows—restake through the platform, receive LRTs, and manage them directly from an exchange wallet. For everyday users, this makes participation in DeFi a lot more accessible.

Beyond that, exchanges can build yield products that bundle LRTs into structured offerings, giving users exposure to restaking rewards without needing to manage the process themselves. These can be targeted at passive investors looking for diversified on-chain income.

Of course, this comes with its own set of requirements. Exchange staking integration has to be handled carefully to ensure transparency, proper token handling, and risk control. There are also legal and compliance factors to address, especially when LRTs interact with underlying staking protocols and third-party services.

Still, the overlap between DeFi and exchange ecosystems is getting stronger. As LRTs grow, they give exchanges a way to participate in on-chain yield strategies while continuing to offer the convenience users expect from centralized platforms.

The Connection with DEXs: LRT Liquidity and Utility

While LRTs are gaining attention on centralized exchanges, their real potential unfolds in decentralized environments. Decentralized exchanges (DEXs) are naturally suited to support LRTs, and many DeFi users are already looking for ways to put these tokens to work on-chain.

One of the first steps is listing LRTs on DEXs and pairing them with key assets like ETH, stablecoins, or other restaked tokens. This creates LRT liquidity pools where users can provide liquidity and earn a share of swap fees or farming rewards. It also sets the stage for building structured yield opportunities, all within permissionless ecosystems.

Apart from liquidity, LRTs can also play a role in on-chain governance. Projects issuing LRTs may allow holders to vote on protocol upgrades, fee models, or validator sets. This makes the tokens not just productive assets, but also governance tools that contribute to protocol direction.

For developers and protocol teams, there’s a strong case for building custom DEX features with native support for LRTs. This includes things like integrated staking dashboards, auto-compounding strategies, and tools for managing risk across different restaking positions.

At Codezeros, we’ve helped teams architect smart and scalable DEX systems. If you're exploring DEX development focused on staking-related assets like LRTs, it's important to build with flexibility, modularity, and real-time analytics in mind. These systems are going to play a major role in how restaking interacts with the broader DeFi stack.

As the demand for LRT integration grows, so does the need for reliable decentralized exchange development services. The future of staking isn’t just on-chain—it’s fluid, composable, and community-owned. DEXs are where that vision comes to life.

Future of Blockchain Staking with Restaking & LRTs

The way blockchain networks approach staking is going through a shift—and it’s not just a passing trend. Restaking and liquid staking protocols are setting the stage for a more flexible and efficient staking layer, and 2025 could be the year this starts to scale beyond early adopters.

In the near term, we’ll likely see more protocols adopt restaking models either directly or by integrating with platforms like EigenLayer. These systems offer smaller chains a way to bootstrap trust without needing a large validator set of their own. For users, it’s a chance to earn more from the same capital, which is already driving activity across multiple LRT platforms.

Looking further out, restaking trends in 2025 will probably move into institutional territory. Enterprises and funds already active in staking will want to explore restaking as a way to maximize returns without increasing exposure. With proper compliance and risk frameworks in place, restaking could become a core part of institutional staking strategies—especially for Ethereum and other Layer 1s.

Another area to watch is multi-chain staking. Right now, most restaking activity happens within a single network. But as more chains adopt shared security or modular consensus models, we’ll start to see restaked capital flow across ecosystems. That opens the door to cross-chain LRTs, composable yield across rollups, and broader interoperability between staking protocols.

The future of blockchain staking is going to look a lot different from what we’ve seen so far. Capital won’t just sit in one place. It’ll move, adapt, and serve multiple roles—all while staying secure and productive. Restaking and LRTs are early signals of that shift.

Why Work with Codezeros for Blockchain & Staking Infrastructure

Restaking and LRTs bring new complexity to protocol design. To build something secure, efficient, and scalable, you need a development partner who understands how staking fits into the broader blockchain ecosystem.

Codezeros has worked with teams across the space to design and deploy advanced staking systems, restaking frameworks, and DeFi infrastructure. We provide full-stack blockchain development services—from protocol logic and tokenomics to smart contract audits and on-chain integrations.

Our team has delivered custom DEX development solutions and supported cryptocurrency exchange development projects with features like staking-as-a-service, custom reward structures, and liquidity management tools. We understand the practical demands of bringing these ideas into production, both from a technical and compliance standpoint.

If you're building a staking product or planning to explore restaking with LRTs, we’re here to help you architect it the right way.

Conclusion

Restaking and Liquid Restaking Tokens (LRTs) are shaping a new path forward for staking in blockchain. They allow users to earn more without giving up access. They open the door to better security for new protocols. And they bring capital efficiency to the heart of DeFi.

This isn’t just a technical upgrade. It’s a shift in how users interact with staking, liquidity, and rewards. As new staking models gain ground, the need for flexible, secure, and well-designed infrastructure is only going to grow.

At Codezeros, we are building with this future in mind. If you're exploring restaking, LRTs, or any custom blockchain solution, let’s connect and build something that lasts.

FAQs

What is the difference between staking and restaking?

Staking involves locking your tokens to help secure a blockchain network and earn rewards. Restaking goes a step further. It allows those already staked tokens to be reused to secure additional protocols, often through shared staking infrastructure. This creates a layered security model and helps optimize the use of capital.

Are Liquid Restaking Tokens (LRTs) safe?

LRTs are built on top of smart contracts and depend on the security of the protocols they interact with. While they offer flexibility and yield, they also introduce more points of exposure. It is important to evaluate the contract audits, platform reputation, and how the restaking logic is implemented. Like any DeFi tool, understanding the risks is key.

Which protocols offer liquid restaking in 2025?

Some of the leading protocols offering LRT tokens and restaking support in 2025 include EigenLayer, EtherFi, Renzo, and Karak. These platforms are experimenting with different restaking models while enabling DeFi composability and yield strategies through tokenized positions.

How can exchanges support LRTs?

Exchanges can support LRTs by listing them as trading pairs, adding them to structured yield products, or offering staking-as-a-service features that integrate restaking options. Proper blockchain automation and risk management systems are important for smooth handling and compliance.

Can I build my own LRT protocol?

Yes, you can. Building a custom LRT protocol requires a solid understanding of blockchain automation, smart contract development, and staking systems. Partnering with a development team experienced in token infrastructure and DeFi protocols can help speed up the process and reduce risk.

Post Author

As a distinguished blockchain expert at Codezeros, Paritosh contributes to the company's growth by leveraging his expertise in the field. His forward-thinking mindset and deep industry knowledge position Codezeros at the forefront of blockchain advancements.

Partner with Codezeros to develop custom Liquid Restaking Token frameworks

Whether you're launching an LRT-powered protocol, integrating restaking into your DEX, or upgrading validator tooling, our team helps you design and deploy with full-stack technical precision.