SHARE THIS ARTICLE

The Rise of White-Label Crypto Exchanges: Dominating the Market with Turnkey Solutions

The cryptocurrency market has grown astronomically in recent years. It has garnered the attention of investors, businesses, and technology enthusiasts alike. With the expansion of the digital asset space, the demand for platforms facilitating crypto trading has increased. Traditional cryptocurrency exchange development, while essential, often involves substantial investments in technology, security, and regulatory compliance.

White-label crypto exchange development, on the other hand, is a different story. These pre-built platforms offer an optimized approach for businesses to establish their own branded cryptocurrency trading platforms. Unlike traditional exchanges, which require extensive development and operational expertise, white-label solutions provide a ready-made framework that can be customized to reflect a company's unique identity.

White-label crypto exchanges present a strong proposition for businesses looking to capitalize on the burgeoning crypto market. By tapping into these turnkey solutions, enterprises can accelerate their time-to-market, reduce development risks, and benefit from economies of scale. This approach allows businesses to focus on their core competencies, such as marketing, customer acquisition, and regulatory compliance, while a trusted provider handles the complex technical infrastructure.

White-label crypto exchanges are revolutionizing the industry by providing a rapid, cost-effective, and scalable entry point for businesses, allowing them to dominate the market. Let’s understand the intricacies of white-label exchanges, exploring their architecture, benefits, and the factors to consider when selecting a provider.

Understanding White-Label Crypto Exchanges

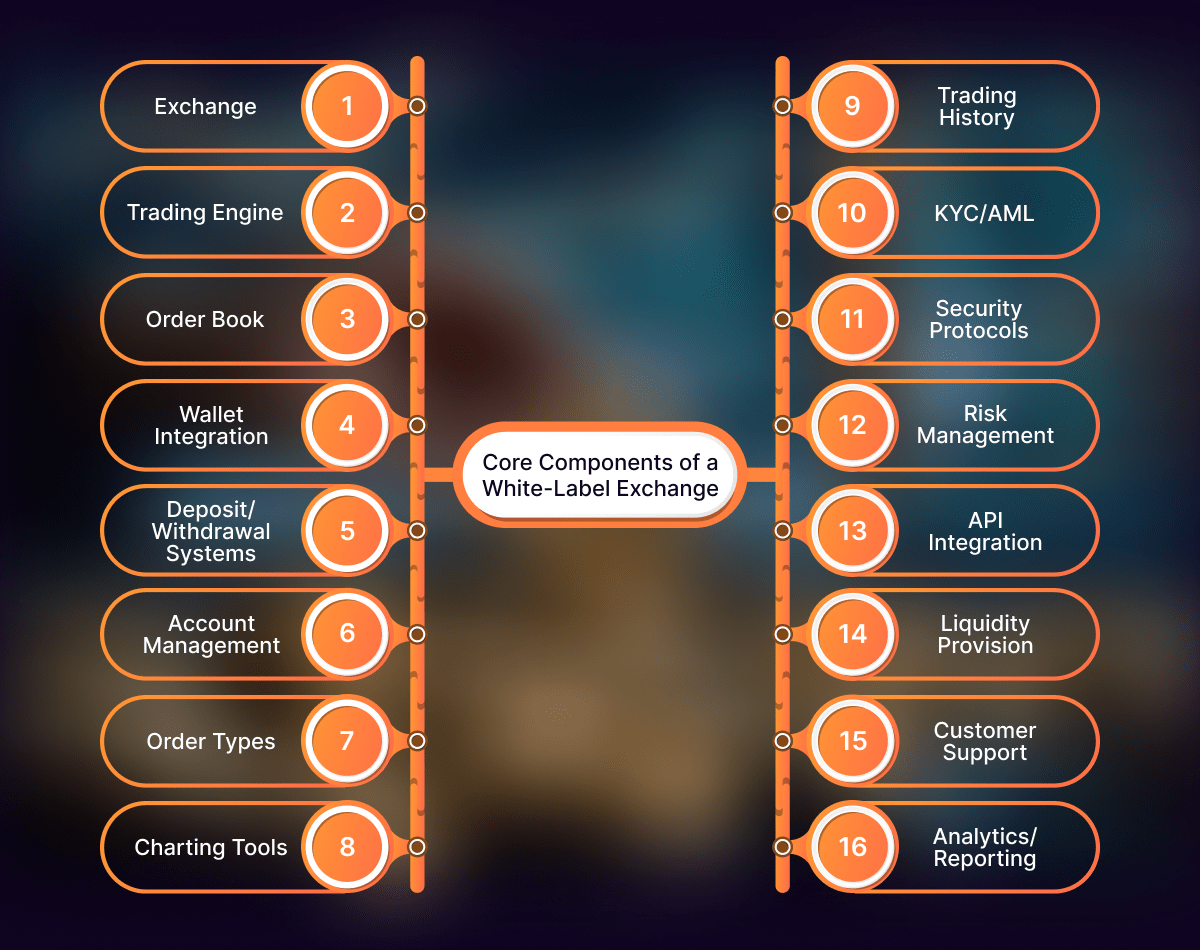

Core Components of a White-Label Exchange

A white-label crypto exchange is a complex system built on a sturdy technological foundation.

Trading Engine: The core of any exchange, the trading engine is responsible for matching buy and sell orders with speed and precision. It facilitates fair and efficient order execution, a foundation of a reliable exchange.

Order Matching: The trading engine depends on sophisticated order-matching algorithms to determine the best price and volume for each trade. This optimization is crucial for a smooth trading experience.

Wallet Integration: To facilitate smooth trading, white-label exchanges integrate digital wallets. These secure platforms allow users to store, manage, and transfer their cryptocurrencies with ease.

Security Protocols: Given the inherent risks in the crypto world, effective security measures are crucial. White-label platforms employ advanced encryption techniques to protect user data and funds. Additionally, cold storage, a method of storing cryptocurrencies offline, is often implemented as an extra layer of protection.

Liquidity Provision: A liquid market is essential for traders. White-label platforms often integrate with liquidity providers to offer ample trading opportunities, improving the overall user experience.

The Role of APIs and Integration

To improve functionality and adaptability, white-label exchange development services utilize Application Programming Interfaces (APIs). These interfaces act as bridges, allowing integration with third-party services. By incorporating APIs, exchanges can:

-

Integrate with payment gateways for efficient deposits and withdrawals.

-

Connect with analytics tools to gain valuable insights into user behavior and market trends.

-

Integrate with trading bots to automate trading strategies.

This flexibility allows exchanges to personalize their offerings to specific market segments and user preferences.

White-Label vs. Crypto Exchange Script

It's crucial to differentiate between a white-label exchange and a crypto exchange script. While both involve pre-built software, they differ significantly.

-

White-Label Exchange: A comprehensive platform that includes essential features, ongoing support, and effective security measures. It is ready for deployment with minimal customization.

-

Crypto Exchange Script: A basic framework requiring considerable development and customization to become a fully functional exchange. It often lacks essential features and support.

Key Features of White-Label Exchanges

A successful crypto exchange depends on a robust feature set and a user-centric experience. White-label platforms offer a comprehensive suite of tools to meet these requirements.

Core Exchange Functionalities

Trading: A user-friendly interface for buying, selling, and trading cryptocurrencies, including order types, market depth, and trading history.

Deposits and Withdrawals: Secure and efficient methods for depositing and withdrawing funds, supporting various fiat and cryptocurrency options.

Account Management: An efficient system for user registration, profile management, security settings, and transaction history.

Advanced Features

To attract and retain users, many exchanges offer advanced features.

-

Staking: Enabling users to earn rewards by holding supported cryptocurrencies.

-

Lending: Facilitating peer-to-peer lending of cryptocurrencies with interest accrual.

-

Derivatives: Providing trading opportunities on derivatives like futures and options for advanced traders.

Security and Compliance

Protecting user assets and adhering to regulatory requirements are essential. Reputable white-label providers prioritize these aspects.

-

Robust Security: Implementing advanced security measures such as encryption, two-factor authentication, cold storage, and regular security audits.

-

KYC/AML Compliance: Integrating Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to prevent fraudulent activities.

-

Regulatory Adherence: Ensuring compliance with relevant financial regulations and industry standards.

The Advantages of White-Label Solutions

White-label crypto exchange development offers a myriad of benefits for businesses seeking to enter the dynamic cryptocurrency market.

Accelerated Time-to-Market

White-label cryptocurrency exchange platforms are designed for quick implementation, allowing businesses to launch their exchange within a considerably shorter timeframe compared to building from scratch. By entering the market rapidly, businesses can establish a strong foothold and gain a competitive edge.

Cost Efficiency

White-label solutions eliminate the substantial upfront costs associated with building an exchange's infrastructure, technology, and personnel. Businesses can benefit from economies of scale as the white-label provider shares development and operational expenses across multiple clients.

Proven Technology and Security

White-label platforms are built on mature technology stacks, offering reliable performance and scalability. These platforms incorporate industry-leading security measures, protecting user funds and data from cyber threats. Most white-label providers are well-versed in crypto regulations, assisting businesses in adhering to compliance standards.

Focus on Core Competencies

By outsourcing the technical aspects of the exchange, businesses can concentrate on their core strengths, such as marketing, customer acquisition, and risk management. This focus allows for optimized resource allocation and improved operational efficiency.

Scalability and Flexibility

White-label platforms are designed to handle increasing user volumes and trading activity, ensuring seamless scalability. While providing a pre-built foundation, white-label solutions often offer customization options to align the exchange with a business's branding and specific requirements.

Risk Mitigation

White-label exchange development service providers have established processes and experienced teams to manage operational risks, such as system failures and security breaches. By utilizing a proven white-label platform, businesses can reduce the risk of investing heavily in a technology that may not be market-accepted.

The Business Case for White-Label Exchanges

The cryptocurrency market presents a substantial opportunity for businesses to capitalize on the growing demand for digital assets. The number of cryptocurrency users has risen, driving a corresponding increase in trading volume and the need for reliable exchange platforms. However, executing a P2P exchange development from scratch is a complex and resource-intensive endeavor.

White-label crypto exchanges offer a compelling business case by addressing key challenges and maximizing potential returns. A significant advantage lies in cost savings and accelerated time-to-market. By eliminating the need for extensive development, testing, and regulatory compliance from scratch, businesses can reduce expenses by an estimated 30-50% compared to building an exchange in-house. Moreover, white-label solutions typically have shorter implementation timelines, allowing businesses to launch their platform and start generating revenue much faster.

Scalability and flexibility are vital for success in the dynamic crypto market. White-label exchanges are designed to accommodate fluctuating user volumes and trading activity, providing traders with a hassle-free experience. Furthermore, these platforms often offer customization options, allowing businesses to customize the exchange to their specific branding, features, and target audience.

For white-label exchange operators, multiple revenue streams can be explored. Traditional fee-based models, such as trading fees, deposit fees, and withdrawal fees, form the foundation. However, there are additional revenue avenues as well.

-

Listing fees: Charging fees to cryptocurrency projects for listing their tokens on the exchange.

-

Data licensing: Providing market data and analytics to third-party applications and services.

-

Staking rewards: Offering staking services for supported cryptocurrencies and generating income from staking rewards.

-

Value-added services: Providing additional services like custody, lending, or derivatives trading.

Choosing the Right White-Label Provider

Selecting the optimal white-label provider is a critical decision that can significantly impact the success of your crypto exchange. Several key factors should guide your selection process.

Key Selection Criteria

-

Reputation and Experience: Prioritize providers with a proven track record in the crypto industry. Look for a strong reputation for reliability, security, and customer satisfaction.

-

Technology Stack: Evaluate the underlying technology platform, including the trading engine, wallet infrastructure, and security protocols. An efficient technology stack is essential for a high-performance exchange.

-

Customization Options: Assess the level of customization offered by the provider. The ability to customize the exchange's branding, features, and user experience is crucial for differentiation.

-

Regulatory Compliance: Make sure the provider is knowledgeable about relevant crypto regulations and can assist with compliance efforts.

-

Security Measures: Prioritize providers with a strong commitment to security, including strong encryption, cold storage, and regular security audits.

-

Customer Support: Evaluate the quality and responsiveness of the provider's customer support. Reliable support is essential for addressing technical issues and resolving user inquiries.

-

Scalability: Consider the provider's ability to handle increasing user volumes and trading activity as your exchange grows.

Comparison of White-Label Platforms

While detailed comparisons of specific white-label platforms are beyond the scope of this blog, it's essential to conduct thorough research. Consider the following factors.

-

Core features and functionalities: Compare the standard features offered by different providers.

-

Customization options: Evaluate the level of flexibility in customizing the exchange to your brand and preferences.

-

Pricing models: Compare the cost structures and fee arrangements of different providers.

-

Technology stack: Assess the underlying technology and its compatibility with your business goals.

Due Diligence and Negotiation

Once you've shortlisted potential providers, conduct in-depth due diligence.

-

Reference checks: Contact existing clients to gather feedback on the provider's performance.

-

Security audits: Review the provider's security protocols and certifications.

-

Legal and regulatory compliance: Verify the provider's adherence to relevant laws and regulations.

Negotiation is a crucial step in securing favorable terms. Consider factors such as pricing, customization options, support services, and contract terms.

Codezeros is uniquely positioned to be your ideal white-label provider. With our extensive experience in blockchain development, cryptocurrency exchange development, and secure wallet solutions, we offer a cutting-edge platform that combines robust security, unparalleled performance, and extensive customization options. Our dedicated support team is committed to ensuring your success.

Case Studies and Success Stories

The white-label crypto exchange model has proven to be a successful strategy for numerous businesses.

Binance

While Binance is primarily known for its own exchange, it also offers white-label solutions. Many smaller exchanges have tapped into Binance's technology and liquidity to launch their platforms. These exchanges have often benefited from Binance's strong brand reputation and access to a vast user base.

KuCoin

KuCoin has harnessed its core exchange to offer white-label solutions to other businesses, allowing them to launch their own branded crypto exchanges. By providing white-label services, KuCoin has expanded its market reach and revenue streams while sharing its technology and expertise. KuCoin's focus on user experience, security, and a wide range of supported cryptocurrencies has contributed to its success.

Huobi

Similar to KuCoin, Huobi has ventured into the white-label exchange market, offering customizable platforms to businesses seeking to enter the crypto space. Huobi's strong brand recognition and technological capabilities have positioned it as a competitive player in the white-label exchange market. Huobi's focus on providing a secure and user-friendly platform, coupled with its diverse range of services, has been key to its success.

The Future of White-Label Crypto Exchanges

The crypto industry is characterized by rapid evolution, and the white-label exchange market is no exception. Several trends and advancements are shaping the future of this sector.

Emerging Trends

-

Institutional Adoption: With increasing institutional interest in cryptocurrencies, white-label exchanges may cater to this segment by offering specialized trading tools, custody solutions, and regulatory compliance.

-

Tokenization: The tokenization of real-world assets is expected to grow, and white-label exchanges could play a role in facilitating the trading of these tokenized assets.

Technological Advancements

-

Artificial Intelligence (AI): AI can be harnessed for tasks like fraud detection, risk management, and personalized trading recommendations.

-

Blockchain Scalability: Advancements in blockchain technology, such as layer-2 solutions, can improve the speed and efficiency of crypto transactions, benefiting white-label exchanges.

-

Enhanced Security: Continuous development in security technologies will be crucial for protecting user funds and data.

Regulatory Framework

The regulatory environment for cryptocurrencies is advancing rapidly. White-label exchanges will need to adapt to changing regulations.

-

Compliance Focus: Providers will prioritize compliance with anti-money laundering (AML) and know-your-customer (KYC) requirements.

-

Licensing and Permits: Obtaining necessary licenses and permits will become increasingly important.

-

Regulatory Clarity: A clearer regulatory framework could foster innovation and investor confidence.

The Future Role of White-Label Exchanges

White-label exchanges are set to play a pivotal role in the future of the crypto ecosystem. They can serve as a catalyst for broader adoption by providing accessible and secure trading platforms. As the industry matures, white-label solutions may become even more essential for businesses looking to enter the crypto market efficiently.

Moreover, white-label exchanges can contribute to the development of a more inclusive crypto ecosystem by offering personalized platforms for specific demographics or geographic regions.

Codezeros is your partner in building a successful crypto exchange. Our white-label solution combines cutting-edge technology, efficient security, and unparalleled support to help you achieve your goals. Contact us today to learn more!

Post Author

Explore Deep's insightful blog posts that help businesses stay ahead of the curve, explore new possibilities, and unlock the full potential of blockchain technology

White label crypto exchange development

Launch your white-label crypto exchange with personalized solutions from Codezeros. Partner with Codezeros to build a successful crypto exchange. Our white-label solutions offer a rapid path to market, robust security, and ongoing support. Contact us for a consultation.